Man plays college football. Man gets drafted into the NFL. Man makes millions doing what he loves. Man loses it all.

It’s a story you’ve heard time and time again. That’s because an estimated 80% of retired NFL players go broke in their first three years out of the League, as Sports Illustrated and Forbes report.

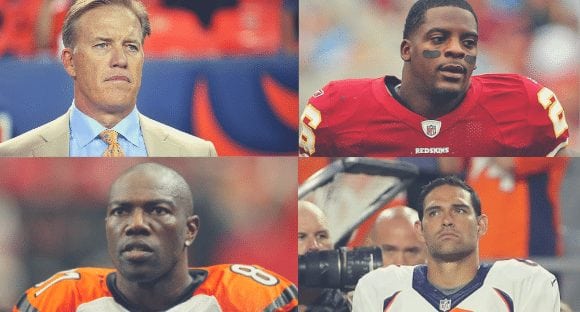

So how do these star athletes go from multi-million dollar contracts to bounced checks? Take Mark Sanchez, John Elway, Terrell Owens, and Clinton Portis. They all have one thing in common: they were NFL players involved in unsavory activities by their investment advisor.

Though the NFL provides a list of “approved financial advisors”, that doesn’t mean they are the best choice. In fact, Mark Sanchez’s financial advisor was on the list and he was barred by the U.S. Securities and Exchange Commission (SEC) in an action five months ago for stealing $20 million dollars from Sanchez and two other players.

This year’s NFL draft just took place. What’s the best advice for the 2017 draftees?

Here are 3 tips from leading national financial expert Kevin Neal:

1) What does your financial advisor’s background check show?

The first step should be using BrokerCheck to see if the financial advisor has the proper experience and has not had any disclosable actions against them. BrokerCheck is the first step but not the last as many disclosable items such as fraud, civil cases, DUI’s and more are left to the advisor to share with FINRA and the SEC.

2) Does the advisor have good historical returns?

An investment advisor is being hired to help with planning and cash flow but the real money paid to an advisor is for risk-adjusted returns based on clients’ goals. Make certain you know how the advisor has performed in the past.

3) Where does the advisor work?

We don’t mind financial advisors striking out on their own or deciding to work for a large Wall Street firm but regardless of where they work the choice has consequences. If on their own, we need a deeper dive on who controls the accounts, how reporting is done, and what happens when something goes wrong. For larger Wall Street firms, we want to know the clients’ interests are first and how investment decisions are made.

The key to avoiding incompetent financial planning advice or corruption is asking these three important questions. Players who lack the financial understanding to properly evaluate their advisors can easily become yet another cautionary tale. Never stop educating yourself and never stop asking questions.

https://www.linkedin.com/pulse/from-fortune-fumbling-3-tips-nfl-players-how-protect-money-kevin-neal